Send us a message, and we will definitely consider your suggestions and comments.

Articles

Two applications (for VAT refund and compensation) will be combined into one form, and the refund limit will be increased to 50%. These and several other significant amendments have been included in the draft amendments prepared by the Ministry of Finance. Amendments will be made to ten by-laws regulating tax and customs aspects of businesses.

During the years of independence, medium-sized businesses appeared in Moldovan winemaking (some of them even became large ones). And in recent years, many small and micro-enterprises have been established, as a legal framework favorable for amateur winemakers to become professionals has been created. Among the clients of maib, the largest bank in the country, there are also plenty of them. Ion Vrabie, maib’s regional director and head of HUB Sud, tells us how they are dealt with.

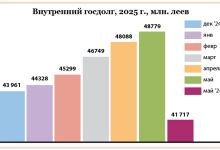

The need for domestic borrowings and the possibility to buy back expensive instruments makes the Ministry of Finance constantly maneuver and search for the most pragmatic approaches to work with government bonds. The policy of government debt management in the domestic market, as experts believe, will proceed from necessary and sufficient, cooling the demand for profitable government securities.

The wine sector is not only an important sector of the Moldovan economy, but also part of the national identity. Sergiu Munteanu, Director of Corporate Client Relations, tells us how maib builds sustainable partnerships with the country’s leading wineries, what solutions it offers to large businesses and why clients choose maib.

The Ministry of Finance has prepared a package of tax amendments to legislation. They will be included in the Tax, Customs, Civil, Administrative Codes and other legislative acts. As the ministry explains, these are adjustments of the first necessity, which improve the legal framework of taxation and do not bear any delay. Since the current Parliament has just over a month to work, the amendments should be adopted by the end of June this year.

maib announced the launch of the bank’s third issue of corporate bonds for 150 million lei within the third public offer program. As the bank notes, the new subscription for corporate bonds will be available for 20 calendar days, starting from May 29. Within this subscription, the bank provides future investors with 7500 corporate bonds with a nominal value of 20 thousand lei per bond, while the principle “first come – first received” continues to operate.

The report on road use tax on vehicles registered in Moldova (Form TFD 19) may be canceled. In this case, the obligation for its calculation by taxation subjects will also be canceled. It should be reminded that today the report must be submitted by taxpayers annually until January 25.

A draft law has been registered in Parliament which proposes to prohibit the marketing and sale of risky investments. A number of amendments to the Law on Capital Market are proposed for this purpose.

The European Commission appreciated the reforms in Moldova’s economic and monetary fields and the progress in terms of strengthening the NBM’s independence.

BILANŢUL CONTABIL B.C. «ENERGBANK» S.A. pentru anul 2024 SITUAŢIA INDIVIDUALĂ A POZIŢIEI FINANCIARE LA…

Trump’s duties will not directly affect the Moldovan IT sector, but may indirectly affect the activity of companies whose partners operate on the American market,” Logos Press reported.

As of April 1 of this year, the Law No. 34 “On Cash Settlements” came into force in Moldova, which significantly restricts the movement of cash in the economy. Although this moment was postponed due to insufficient preparation of the parties, it continues to raise questions and doubts even today.