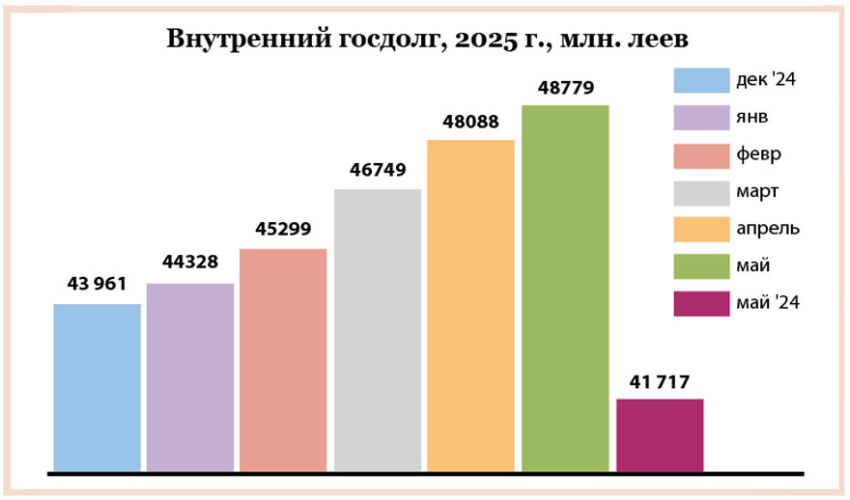

The domestic debt increased to 48.8 billion lei in May against 48.1 billion lei in April and 41.7 billion lei in May. It increased by 691 million lei during the month. At the same time, the government’s internal borrowing amounted to more than one billion lei in May.

According to economist Vladimir Golovatiuc, the difference is due to the fact that the Finance Ministry bought back some government bonds issued in the 90s as a result of converting the government’s direct debt on loans received from the NBM into government securities.

As of May 31, 2025, according to the Ministry of Finance, the domestic public debt increased by 4,817.7 million lei compared to the situation at the beginning of the year and amounted to 48,778.9 million lei.

The change in the domestic public debt was due to an increase in the issuance of state securities (VMS) on the primary market by 4,902.1 million lei at nominal value, as well as to the issuance of VMS through the electronic platform eVMS.md by 360.3 million lei and to the redemption of converted VMS in the amount of 443.4 million lei, the Finance Ministry said.

The situation on the SS market remained favorable in May. At the maximum volume of the offered issue over the last 15 months, the demand exceeded the supply by 40%. At the same time, sales were lower than the Ministry of Finance’s offer.

“The Ministry of Finance is not experiencing difficulties with the placement of government securities. Demand for government securities remains high, thanks to long-term securities. Therefore, I believe that the demand for government securities will remain high in the future, and the planned indicators of domestic borrowings will be exceeded by the end of the year,” says economist Vladimir Golovatiuc.

At the same time, the expert believes that the demand for government securities is cooling, reducing the appetite of investors for profitable government securities. Borrowers play down and cut off the demand with relatively high requested yield. As a result, the Ministry of Finance did not sell the whole announced volume (230 million lei out of 4.350 billion lei), but did not allow an increase in yields on government securities.

“All this preserves the possibility for the government to continue borrowing on the domestic market at relatively low rates. For 2 months now, the average rate has been hovering around 9.8%, while in 2H 2022 it was around 20%.

According to the Ministry of Finance’s calculations, for 5 months of 2025, the weighted average interest rate on VMS circulating at auctions amounted to 8.86% (by type: 91 days – 3.02%, 182 days – 8.44%, 364 days – 9.47%, 1 year – 8.00%, 2 years – 7.82%, 3 years – 7.67%, 5 years – 8.50% and 7 years – 8.96%), which, compared to 2024, is 3.9 pp higher.

The growth rate of domestic government debt planned by the state budget this year outpaces the growth rate of total government debt. The total state debt will increase by 12.4%, while the domestic debt – by 21%. The government has planned to borrow 45,771.2 million lei on the primary market. Also, the government plans to borrow 600 million lei through direct placement among individuals.

The net domestic financing will amount to 8,130.0 million lei, taking into account that the difference in the sources of financing is used to repay the debt during the year. At the same time, the average rate will be 5.5% per annum, with a repayment structure of about 90% for short-term SS and 10% for long-term ones. CS with fixed interest rate depending on demand and market fluctuations will be considered acceptable.