For many nations, gold is no longer just a protective asset – it has become a strategic reserve in the face of growing geopolitical tensions, currency instability and efforts to diversify reserves away from dependence on the US dollar.

However, not all countries followed the same strategy: some actively increased their reserves, while others, on the contrary, reduced them.

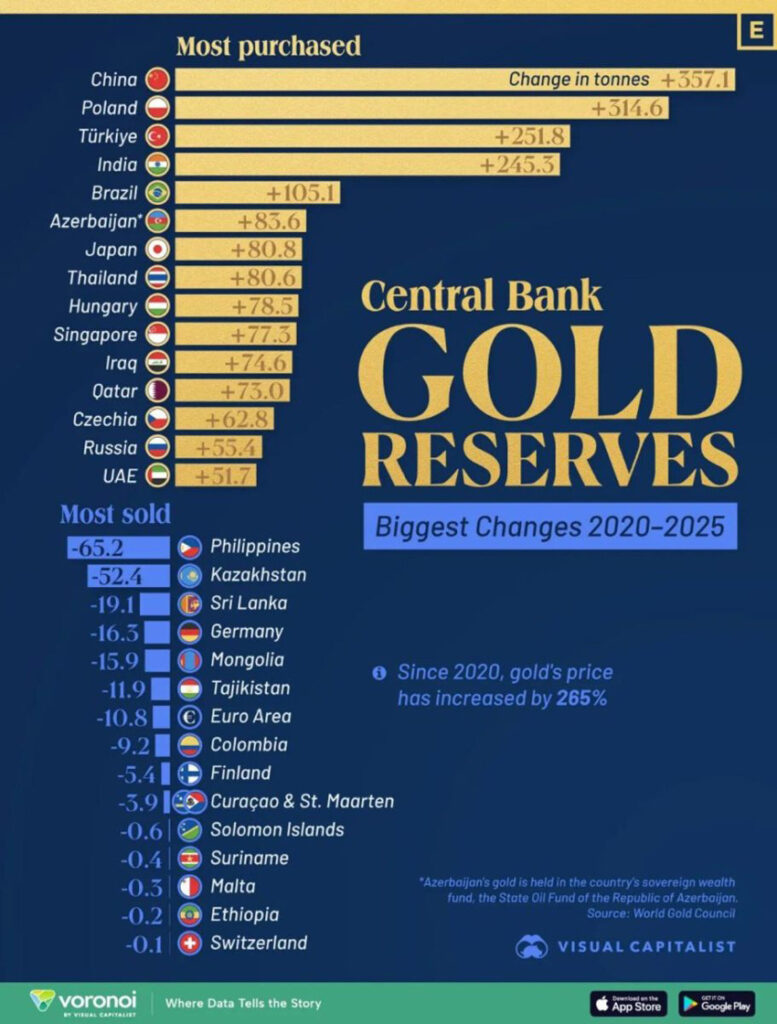

The infographic, based on data from the World Gold Council, ranks countries by the largest net increase and decrease in gold reserves over the past five years.

Leading group of gold buyers

China posted the largest increase, adding more than 350 tons of gold. The move is in line with Beijing’s long-term strategy to diversify reserves away from dependence on the U.S. dollar and reduce vulnerability to the Western financial system, reinforcing gold’s role as a politically neutral asset in the international reserve structure.

Poland ranked second, increasing its gold reserves by more than 300 tons as part of its long-term policy of strengthening financial stability.

Turkey and India were also among the largest buyers. Both countries are characterized by sustained inflationary pressures and volatile national currencies, which makes gold an attractive hedging instrument as part of official reserves.

In addition to the leaders, a number of developing countries also recorded notable replenishment of reserves. Brazil purchased more than 100 tons of gold, and Azerbaijan increased its reserves through the State Oil Fund of the Republic of Azerbaijan.

Japan, Thailand, Hungary, Singapore and Russia also expanded gold reserves, reflecting broader global interest in gold as a stabilizing asset in times of economic uncertainty.

Gold Trading Participants Ranking

Are sellers the outsiders?

While many central banks have been increasing reserves, some states, on the contrary, have reduced gold reserves, which emphasizes the differences in reserve policy priorities.

The Philippines showed the largest reduction, by more than 65 tons. Significant reductions were also recorded in Kazakhstan and Sri Lanka, which is often associated with the need to maintain domestic liquidity or revise the structure of reserves in the face of economic pressures.

Some European countries, including Germany and Finland, showed moderate decreases. Changes in Switzerland were minimal, reflecting the country’s traditionally stable and prudent approach to managing gold reserves compared to more active buyers.

Taken together, the data presented suggests that gold has reasserted itself as the cornerstone of global reserves – even as nations choose different strategies to prepare for the uncertain future of the global monetary system.