The NBM publishes information on the structure of external debt and notes that the long-term public external debt of Moldova by 99.5% consists of loans obtained not from intragroup (interstate) creditors, but from external sources not related to the state that provides them.

This means that most of the country’s public external debt is formed by borrowing from private foreign investors, international financial organizations (e.g., IMF) or foreign governments that are not part of the same group as the borrowing country.

As of the end of the first quarter, the government external debt occupies 41.3% of the total external debt amounting to $4,343.26 million (+33.0% YTD). Short-term public external debt ($ 2.46 mln) by remaining maturity decreased by 13.6% to $393.78. This means that servicing of external debt for one year or less, including interest on overdue debt, is “ahead of schedule”.

Which is not the case with private external debt. It is worth noting that more than 61.7% of the total short-term debt by remaining maturity are liabilities in the form of commercial loans (machinery, equipment) and advances. Private external debt amounted to $6,173.89 million, an increase of 4.6% over the year. This means that it is more difficult to return the value of incoming benefits in material embodiment.

The Ministry of Finance publishes information on domestic debt as of the end of May 2025. During the five months from the beginning of the year, the domestic public debt increased by 4,817.7 million lei in nominal value and amounted to 48,778.9 million lei. The change in the domestic public debt was due to an increase in the issuance of VMS on the primary market by 4,902.1 million lei, the issuance of VMS through the electronic platform eVMS.md by 360.3 million lei and the redemption of converted VMS in the amount of 443.4 million lei.

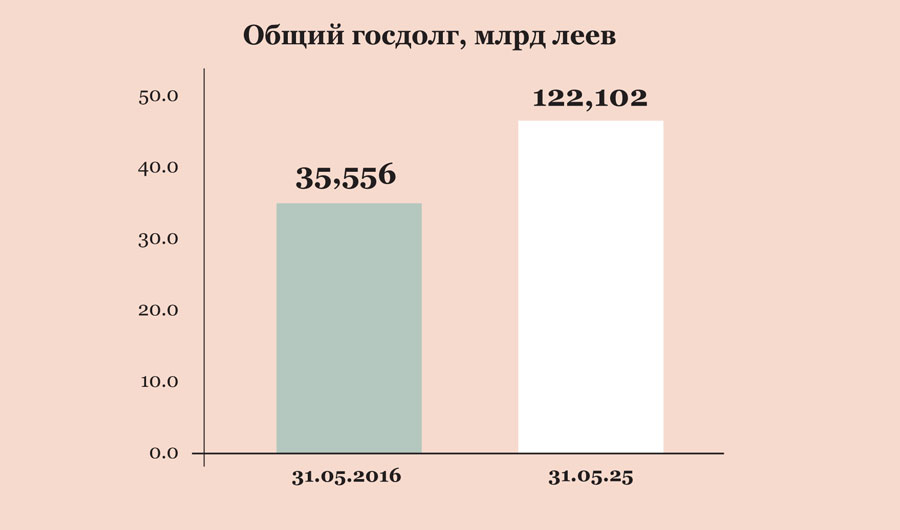

As a result, according to the Finance Ministry’s report, as of May 31, 2025, the balance of the total state debt amounted to 122,101.9 million lei at nominal value, 707.9 million lei more than at the end of 2024. The balance of total public debt, including domestic and external borrowings, to GDP has been decreasing since the beginning of the year: from 37.5% at the end of 2024 to 34.8% at the end of May 2025. A year earlier, it was 32.3%. Over the year (May to May), the total state debt increased by 16.7%, or by 17.5 billion lei.

Last year, the cost of servicing the state debt (interest and commissions) amounted to over 4.2 billion lei. For the first five months of 2025, respectively: internal debt – 931.5 million lei, external debt – 796.4 million lei.