Владимир Головатюк

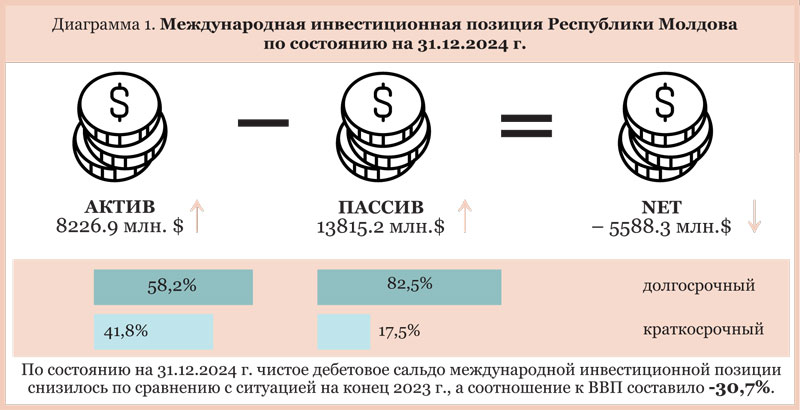

At the end of the year, Moldova’s IIP amounted to -$5,588.30 million, which reflects a long-standing negative bias in external claims and liabilities. In other words – a significant deficit of the current account (foreign trade operations), inefficiency of economic policy, resource base. And with them – and confidence in the country’s capabilities: its residents – to pay debts to non-residents, the authorities – to manage loans and the economy.

According to NBM data, as of December 31, 2024, the country’s investment position in the international credibility rating decreased by 6.2%, while the ratio to GDP amounted to -30.7%, decreasing by 5 p.p., compared to the situation at the end of 2023. The total amount of external financial assets amounted to $8,226.92 million and increased by 5.9% compared to the end of 2023, while the amount of liabilities amounting to $13,815.22 million increased by 0.6%.

The statistical report presented by the regulator on the IIP and balance of payments, reflects at a certain point in time not only the structure and value of financial claims on external transactions, but also to some extent serves as an equivalent of national wealth, speaks about the degree of participation in the global economy, reproduction, experts say.

If the risks are too great, then the IMF comes into play, whose main duty is to provide preferential financing to countries experiencing balance of payments problems. Or – to help pay off old debts at the expense of new ones. According to economist Vladimir Golovatiuc, in 2024, the government received a record volume of foreign loans – more than $1 billion.

“Since mid-2021, the government has borrowed $3 billion from partners. By the way, it also received $1.2 billion in grants. The volume of external loans of PAS governments in 3.5 years exceeded the amount of loans received by the governments of Filat, Leanca, Sagittarius and Filip combined: from 2008 to 2020, $2.7 billion was received,” says the expert.

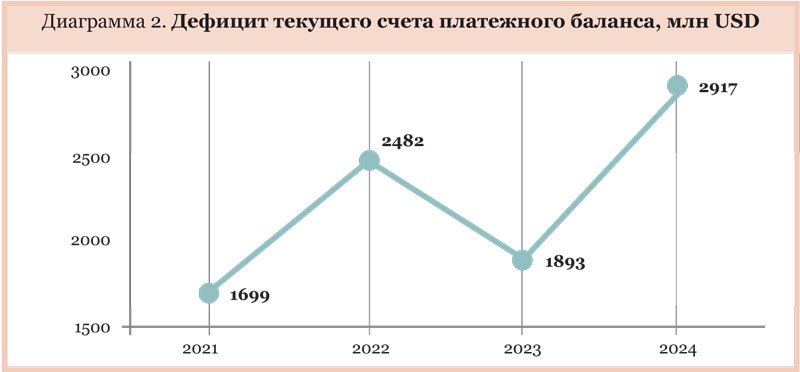

“As a result, we have an absolute record in the size of external lending with negative socio-economic effects – stagnation in the economy and reduction of real incomes, as well as the level of consumption of the population. The current account deficit has reached critical values in 2024. It amounted to more than 16% of GDP. For 30 years, only in 1998 and 2022 it was higher, amounting, respectively, to 19.7 and 17.2% of GDP,” says Vladimir Golovatyuk.

The current account deficit is financed by external borrowing and foreign investment inflows. Capital inflows that do not add to the debt burden are considered normal. Only then the country’s economic potential grows and conditions for sustainable economic development are created, the expert says. Therefore, we are doomed to lag behind the world development and ask for help from outside.

Economist Volodymyr Golovatyuk: – The inflow of foreign direct investment decreased by 9% in 2024, amounting to $570 million against $625 million in 2023. At the same time, the currency actually comes into the country only in the case of investment in capital, not reinvested profits and debt investments, which is nonsense in itself.

By the way, $127 million came in the form of debt investments, and $187 million “went out”. That is the whole “inflow”! Capital investment in 2024 has decreased by 37%. However, if we take into account that the outflow of these investments increased, i.e. the investors who came earlier “left”, the net inflow of investments decreased by 33 times!

In 2023, investments worth $80 million “came”, in 2024 – $51 million. The outflow in 2023 – $46 million, in 2024 – $50 million. Accordingly, the net inflow in 2023 amounted to $34 million, and at the end of 2024 – only one million dollars! And this is with an increase in the current account deficit by the same one million dollars!

What kind of investment attractiveness can we talk about? Only to borrow. And only to make ends meet. Without development, unfortunately!