“Tractor is the head of everything.”

By analogy with the fact that bread/grain is the basis of human diet, why is it possible to take the tractor as a “point of reference” in assessing the level of technical equipment of modern agriculture? Because both the logic of agricultural production and statistics are on the side of tractors’ priority.

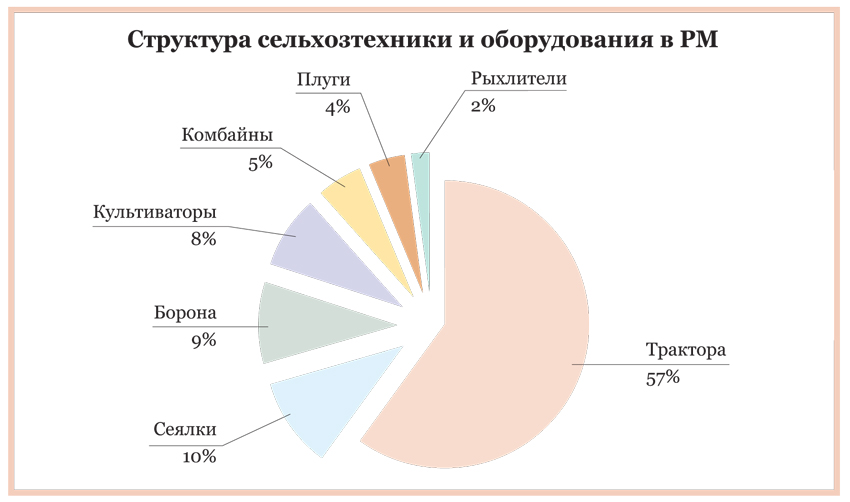

Despite the presence of highly specialized design solutions (for example, machines for greenhouses, orchards and vineyards) and very different engine power, the tractor is a more or less universal “workhorse”, the main pulling force for a very different range of work. For comparison, the other most important type of self-propelled machinery for agriculture, combines – it is always a narrow profile, only harvesting (grain/oilseeds, vegetables, potatoes, berries, etc.). In support of this idea, perhaps controversial in some respects – statistics of the MAIA Ministry of Agriculture and Food Industry.

The number of units of large agricultural machinery and equipment in Moldova exceeds 110 thousand. Of them, tractors – more than 64 thousand (more than 57%), combines – less than 6 thousand (a little more than 5%). Most of the tractor fleet in Moldova is represented by rather old machines: no less than a quarter of their total number is older than 25 years, and only a quarter is younger than the five-year “age of post-guarantee maturity”.

Downward dynamics and market restructuring

In the outgoing five-year period, 2022 was the most optimistic year for tractor imports, with 3,217 units of new equipment imported. That’s because 2021 was one of the highest yielding years of the decade. At the same time, good harvests were supported by high “food inflation” – prices for many types of agricultural products, followed by a significant increase in farmers’ incomes. This influenced their self-esteem and their desire to invest in relatively long-term tangible assets, i.e. in the means of future high-tech and, as it seemed, highly profitable agricultural production.

However, as agricultural machinery market operators note, the number of tractors imported to Moldova are trader’s expectations, reflecting more or less heightened “market sense” and quality of planning rather than actual sales. That is, not all large agricultural machinery is imported by the dealer “under order”, sold and registered by the farmer in the year of delivery.

From this point of view, it is not too surprising that in 2023 compared to the previous year the supply of new tractors to Moldova decreased by a third – to 1930 units, and in 2024 – recovered to the level of just over 2 thousand. From January to August 2025, only 1342 new tractors were imported into the country.

A new “trend of the time” is a sharp increase in the supply of “repaired” used tractors. In the mentioned period of the last year, 691 units of such equipment were imported to Moldova, while in 2022 – only 152. These data tangibly undermine the slogan of Moldovan agribusinessman, not very stable but proud, which seemed unshakable earlier: “only your new tractor can be better than your tractor”. Good or bad, it seems that Moldovan farmers are learning to “invest wisely” – depending on the profitability of agribusiness and actual incomes.

Serghei Pruteanu, director of AgroMester HD:

“Unfortunately, due to the decreasing profitability of agribusiness in the last few years, the segment of premium brand tractors, such as John Deere, is shrinking noticeably in Moldova. At the same time, Moldovan farmers rather quickly got rid of “brand loyalty”, which used to be the preferred brand when choosing agricultural machinery, or an object of envy and aspiration. Some of our former customers – mostly medium-sized farmers with several hundred hectares of land each – have switched from high-end Western farm machinery to Chinese brand tractors. They are more satisfied with the price/quality ratio of machinery from China in the realities of the “new norm” of agro-food markets. What can be the anti-crisis solution for dealers of agricultural machinery of premium brands in such a situation? Probably, as before in difficult periods, to focus on import of spare parts, quality service”.

Another important detail noted by agricultural machinery market operators, which affects the perception of the situation. Of the total number of tractors imported in the current five-year period, no less than 70% are machines with engine power of less than 100 horsepower. Moreover, the bulk of such machinery is not more than 45 horsepower, conditionally, “semi-professional”, for work on household plots. This year, according to customs statistics, the average invoice price of a tractor amounted to 286 thousand lei, which is minus 36% of the corresponding price of machines imported in 2022. That is, we can assume that the share of low-power tractors in the flow of their imports to the Moldovan market has increased – first of all.

Secondly, the fleet of tractors from China is multiplying on the agricultural machinery market in Moldova – both well-known Chinese brands with a long model range (ranked by specialization, capacity, equipment), and equipment, conditionally, “know-name”, mostly low-powered. Chinese tractors of comparable equipment “win the market” against premium brands from the USA, EU and Japan due to the price (although the difference is decreasing). Minus digital options, high-tech components and premium materials, “simple” Chinese tractors are out of competition. All the more so that Turkey, another eastern player on the Moldovan agricultural machinery market, has been losing ground in the tractor segment for the last two or three years due to inflationary pressure and uncompetitive prices for expensive goods.

Oleg Golopyatov, representative of Agropiese TGR, said:

“We can agree that in the last few years, the agricultural machinery market in Moldova has been making a structural transition from post-Soviet machinery (in particular, Belarusian machines, which until recently accounted for a very significant part of the country’s tractor fleet) to tractors of Chinese brands. This is partly due to the fact that, for obvious reasons, tractors from Belarus do not come to Moldova. At the same time, there is a demand for budget, relatively simple and specialized machines of different capacities in the country. Obviously, this demand will be satisfied, and perhaps the market will be redistributed in favor of such tractors.

Limitation of subsidies and global trend

For many years, the Moldovan market of agricultural machinery in general and tractors in particular was formatted by the system of subsidies. Post-investment subsidies played a very important role in it, including partial compensation of farmers’ expenses for new machinery and equipment. Five to seven years ago, the share of agricultural machinery in the structure of post-investment subsidies amounted to at least 40%.

The amount of subsidy for a new tractor was up to 30% of the investment (but not more than 3 million lei “in one hands” and not more than 300 thousand lei for one unit of machinery). Two years ago, restrictions were also introduced on the engine capacity of subsidized agricultural machinery. Nevertheless, the share of subsidy in the price of tractors of premium, conditionally, “Western brands” was 5-10%, “Eastern” – 15-20%, which, to some extent, made the “agony of choice” easier for farmers.

This year, “under the curtain” of its activity, the departed deputy corps adopted a new law on financing agrarian policies. It does not prohibit, but also does not provide for post-investment subsidizing of farmers in the previous form (only subsidies “by installments” – for leasing purchases already made, as well as for advance payments – remain in force). The new law should come into force from the beginning of next year. Perhaps, for the Moldovan agricultural machinery market it will be a new frontier and a shock.

Iurie Rija, an expert in agro-marketing:

“Comparatively weak sales of tractors and other self-propelled farm machinery confirm the slowdown in the global agricultural economy – rising costs and shrinking ‘farmers’ margins’.” The data published in October 2025 by the Association of Equipment Manufacturers (AEM) confirms the global trend: the agricultural machinery market is entering a period of stagnation and recession – both in the USA and in Europe. The Republic of Moldova is not an exception – the context may be different, but the results are similar.

In the US, for example, sales of heavy-duty tractors in 2025 are still about 39% below last year and 23% below the 2015-2023 average. U.S. farmers today are much more selective in their investment decisions, preferring to extend the life of existing equipment rather than purchase new equipment, according to analysts at Terrain, a company specializing in monitoring agricultural equipment.

In Moldova, the agricultural machinery market is adapting to the new realities of the agrarian economy by changing the structure of offers: the emphasis has started to be put on inexpensive, compact, economical and used machines. Moldovan farmers choose pragmatic solutions: low price, simple and inexpensive maintenance. The market is moving from expansion to optimization and maintenance. This transition is not a crisis, but a restructuring in line with the realities of the global agricultural economy”.