The €1.9 billion development plan for Moldova proposed by the European Union can serve as a catalyst for the growth of the national economy only in one case – if the corresponding resources are not eaten up. Otherwise, the economic growth plan developed by the government will be reduced to a mere expansion of budget expenditures. Budget and entrepreneurial support (in the form of subsidies, grants and instruments of access to credit, etc.) is not enough for the transition to sustainable economic development. Without structural changes in the way financial resources are used, they will not have the desired effect. Moreover, it is impossible without significant private investment, believes Adrian Lupushor, Executive Director of Expert-Grup, an independent analytical center.

“Investment funds can play a more significant role in this respect, due to their ability to channel capital into projects with high economic effect,” Adrian Lupushor believes. – Unlike traditional state mechanisms, they can operate with greater flexibility. Romania and other European countries have introduced such instruments in their sustainability plans (NRRPs), using European funds to create investment financial instruments.

The first condition has already been discussed in society: it is necessary to depoliticize the programs through which the state allocates money to the economy (be it subsidies in agriculture, financing of road infrastructure or local development), to exclude various conflicts of interest, etc. The second – to use European money as an impetus to expand its opportunities in order to move to a model of economic growth based on the increase of added value – is only speculatively approached.

What about our financial system? It does not provide the economy with institutional investors because of the underdeveloped capital market, experts believe. And this is one of the main drawbacks of the Moldovan economy – resources are not optimally distributed.

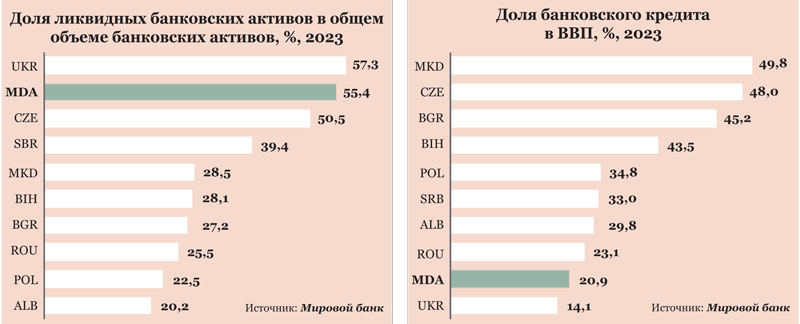

Dumitru Pinta from the Expert-Grup analytical center gives arguments: “On the one hand, we have a high level of liquidity (one of the highest in the region) concentrated in the banking system. This means that we have “free” resources that can be transformed into investments. And on the other hand, we have one of the lowest levels of financial intermediation in the region, which means that “free” financial resources, in fact, are not transformed into investments and, accordingly, do not contribute to economic growth. And this is one of the most obvious paradoxes of our economy,” the expert believes.

His words are confirmed by the fact that in 2024, bank loans accounted for only 47% of the total assets of the banking system. At the same time, Moldova is at the bottom of the ranking of the countries in the region in terms of the share of bank credit in GDP. (See charts) In other words, free resources are not channeled into productive investment activities that generate value added and economic growth.

Most transition economies, according to experts, have specifically relied on private managers and investment funds as instruments to facilitate a more efficient allocation of resources in the economy. The example of Romania, Lithuania or Poland is very telling. In these countries, the assets of investment funds reach from 11% (Romania) to 24% (Poland) in relation to bank lending. And if we talk about lending to the real economy, this ratio increases significantly. In this context, the need for additional financial infrastructure, such as investment funds, capable of mobilizing borrowed capital and directing it to the most productive projects becomes obvious.

There are favorable conditions for this: with the adoption of the Law No. 2/2020 on alternative collective investment enterprises, the development of a new draft law “On the capital market” (which, however, is in no hurry to be adopted), experts note the growing interest of the business environment in diversification of investment instruments and long-term savings. These include corporate bonds, long-term loans, government bonds and investments in private capital. Including entry into foreign, more flexible capital markets. And much more. The matter is small – to start…