INFLATION IN DIFFERENT WAYS

Annual inflation in Moldova fell to 7.8% in April 2025 from 8.8% in the previous month, reaching its lowest level since December 2024. The slowdown was mainly due to a sharp fall in the inflationary impact in the services sector, from 17.1% to 13.8%. The main contributor to this was the decline in natural gas prices. The growth rate of prices for non-food products also slowed down – from 3% to 2% – under the influence of lower fuel costs.

In contrast, food inflation rose from 9% to 9.44% – influenced by higher prices for fruits and vegetables, meat and meat products. Average monthly consumer prices rose 0.9% in April, following a 0.6% increase in the previous month.

The annual price growth, according to the NBS, was caused by the rise in prices of public services (by 13.8%) and food products (by 9.4%). Utilities played a decisive role. Their “contribution” to the annual inflationary growth is estimated by statistics: in descending order – prices for electricity, natural gas, heating, water supply. In April, as compared to March, the growth of average prices for services was mainly due to the rise in prices for transportation services (by 4.7%) and water supply and sewerage services (by 4.5%).

At the same time, the NBS found it necessary to explain that the assessment of the average effective tariffs for natural gas, electricity and heat supply was made taking into account the compensations provided for the payment of energy bills for household consumers – in accordance with Law No. 241/2022 “On the Energy Vulnerability Reduction Fund”.

Thus, the official calculations of the inflationary contribution of household services without compensation payments could have been higher. Then there would not have been a sharp deceleration of inflation for services, due to which there was a general decrease in annual inflation.

In Moldova CPI is divided into three main groups: non-food products (36% of specific weight), food products (38%) and services (26%). The impact of food prices in the consumer basket is estimated to be: meat (8%), milk and dairy products (5%), vegetables (4%), fruits (3%) and bread (2%). Non-food items mainly include fuel (6%), clothing (4%) medical devices (3%) and footwear (2%). The weighted impact of services are housing (9%), utilities (7%) and transportation (3%).

According to the National Bank’s estimates, the slowdown in annual inflation observed since the beginning of the year is not yet stable. The upward trend in annual inflation in the first quarter of 2025 was accompanied by unfavorable sectoral developments, including adjustments in tariffs for gas, heat and electricity. As well as rising food prices due to the drought in the summer of last year.

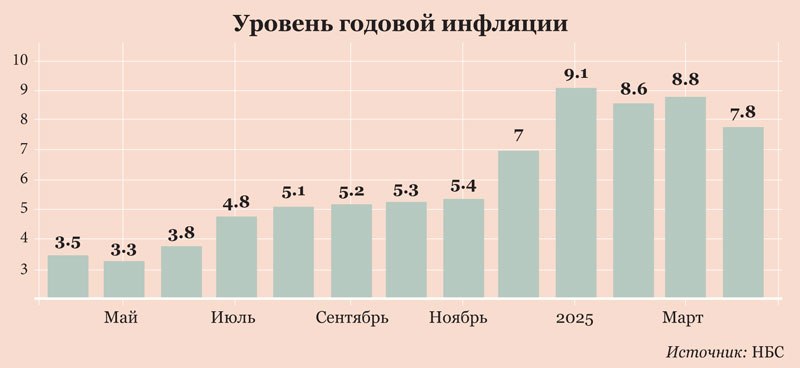

In the first quarter of 2025, annual inflation continued the upward trajectory that began in the middle of the previous year. Thus, the annual inflation rate increased from 7.0% in December 2024 to 8.8% in March 2025. This is above the upper limit of the fluctuation range of the inflation target over the last four months, which is due to the dynamics of regulated prices in the context of adjustments to tariffs for network gas, heat and electricity.

“The annual inflation rate excluding this impact would have been around 6.3% in March 2025, which is within the inflation target range. Meanwhile, the average annual inflation rate in the first quarter of 2025 was 8.8%, about 2.9 percentage points higher than in the previous quarter,” the NBM said.

In April 2025, a more pronounced monthly increase in average consumer prices was recorded for fruits – by 9.3%, vegetables – by 5.3%, vegetable oil – by 3.2%, meat, meat semi-finished products and canned food – by 1.8%. Price decrease was recorded only for chicken eggs – by 5.9%.

As for non-food products, the average consumer prices for fuel decreased by 2.3% (including diesel fuel – by 5.8%, gasoline – by 2.4%, coal – by 1.2%). And the average consumer prices for shoes and clothes increased by 0.8% and, respectively, by 0.6%.

According to NBM estimates, domestic demand continued to remain moderate, as evidenced by the still lower-than-expected dynamics of household consumption. Aggregate demand, including deteriorating conditions for foreign trade, continued to have a disinflationary impact on prices during the reporting period and apparently played a significant role in slowing growth.

Adjustment of energy tariffs and unpredictable nature of subsequent adjustments, as well as the tense situation in the region and risks of its escalation, according to the regulator, “retain pronounced uncertainty about the inflation outlook”.

CLEAR UNCERTAINTY

On the medium-term horizon, the balance of risks to inflation remains tilted towards the pro-inflationary side. The main risks are associated with the deviation of the economy from the balanced growth trajectory and with the deterioration in the terms of foreign trade. Disinflationary risks are associated with a faster slowdown in credit growth and domestic demand under the influence of tighter monetary conditions.

Despite the optimistic scenario of the inflation rate returning soon to the specified deviation corridor, the regulator is not in the clouds. The NBM realizes that there are still high risks that inflation may remain high for a long time. Among them are increased inflationary expectations of the population and businesses, continuing uncertainty with geopolitics, increased trade tensions in the world and weak demand. In this regard, the regulator outlined its outlook:

“While the world’s largest economies have shown a willingness to negotiate trade agreements with the US, and some have reported progress on this front, the announced deadline is quite tight. Which means trade tensions remain. Peace talks over the war in Ukraine appear to have stalled, but events surrounding them have helped justify decisions to increase defense spending in Europe.

EU economies continue to face a slowdown in industrial growth. In this environment, along with stimulative monetary policy, fiscal measures are expected, aimed at revitalizing the EU economy. Oil prices will be mainly affected by global trade tensions as well as OPEC+ decisions to increase production. Natural gas prices in Europe will depend on the ability of countries to fill their reservoirs for the next cold season. Global food prices are expected to develop in a balanced manner”.

NBM HOLDS PAUSE

Although the NBM notes that domestic economic activity and inflation continue to be influenced by the effects of supply shocks in the domestic market and trade tensions in the external market, the outlook is quite favorable: the economy will be under low inflationary pressure all next year.

In other words, the deflationary impact of aggregate demand will be so great that it may finally freeze economic activity. Meanwhile, the regulator is in no hurry to “eliminate” the depressive phenomena, remembering the past experience of inflationary outbursts, and keeps a pause with the change of the key rate. Apparently, in order to minimize the rate of price growth by all means….

This week, the regulator kept the prime rate at 6.5% per annum. Also, the norms of required reserves for banks and on attracted funds in freely convertible currency were kept at the current level.

According to the NBM, this decision was made based on the previous arguments – to limit inflationary expectations. Thus, the restraining measures of the monetary policy continue to operate, given the delay in their introduction.

At the same time, the regulator hints at the possibility of future easing of restrictive measures. It is forecasted that inflation will have a steady downward trend by the end of this year. And in 2006 – to the minimum annual growth rates of 3.6% – 4.0%. Such expectations are connected, first of all, with the weak recovery of domestic demand. And this will have a general disinflationary effect on the rate of price growth.

Nevertheless, the annual rate of core inflation has been revised upward through the second quarter of 2026 and downward for the remainder of the forecast period through the end of 2027.

Food inflation will develop in a wavelike pattern. The annual rate of increase in food prices will continue until the beginning of this summer season, after which it will slow down – until the first half of next year and will start rising again with acceleration – until 2027, the NBM forecasts.

The annual rate of regulated prices will decrease in the first half of the forecast period, followed by stabilization and decrease again – at the beginning of 2027. The annual rate of increase in fuel prices will decline in the first quarter of the forecast, and will record negative values until the second quarter of 2026, after which it will resume growth starting in the third quarter of 2026.

Negative aggregate demand throughout the forecast period will be driven by tight monetary conditions and, to a lesser extent, the negative impact of external demand. Positive fiscal impulse will also have a negative impact on aggregate demand, and will have a disinflationary effect.