“Iute Affinity was created to provide fully digital and personalized insurance solutions through the Myiute app for both our clients and our partners’ clients through direct partnerships with leading global insurers and service providers such as Allianz Partners, UNIQA and MediGuide,” Niinepuu said.

He added that while Iute has operated as an insurance intermediary in recent years, bringing affinity insurance competencies in-house supports the company’s ambitious plans to become a full-fledged digital bank.

Iute Affinity does not act as a traditional insurer. The subsidiary helps integrate insurance into Iute’s existing services, be it health, property or other types of protection. Customers no longer have to go to other providers: claims and support are handled within the Iute ecosystem, which ensures faster resolution, clearer communication and a consistent level of brand trust.

“People don’t see insurance as a standalone product. They think in terms of everyday moments, paying bills, traveling or shopping and want everything to run smoothly and stress-free. Iute Affinity helps make insurance a natural component of these moments, integrated into the digital journey, not added on later,” said Ribanovic.

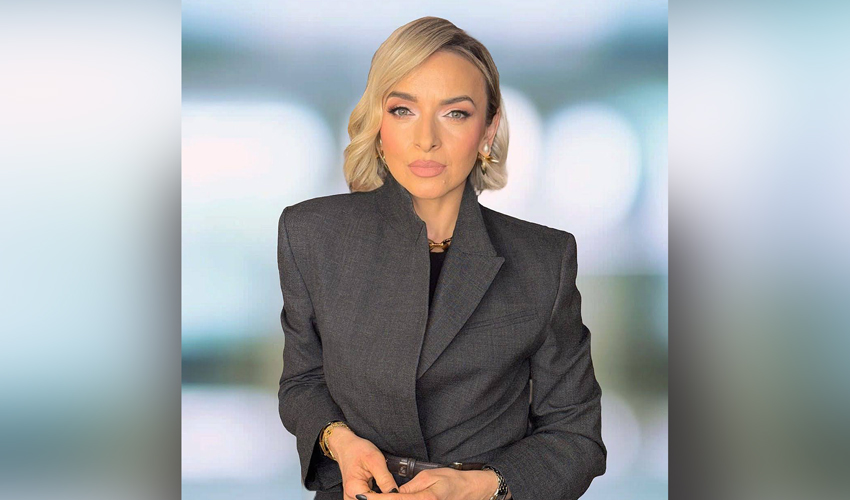

Alma Ribanovic will lead the new subsidiary, bringing with her more than 20 years of experience in banking, insurance and strategic partnership development, with a strong focus on affinity, bancassurance and embedded insurance solutions.

Iute Affinity will operate as an integrated part of Iute Group, working closely with the commercial, technology, risk and compliance teams. This ensures that the insurance solutions will adhere to the same standards of transparency, discipline and customer focus that Iute requires for its core digital financial services.

In the first phase, Iute Affinity will support markets where Iute Group already operates, working with international insurance and service providers. To accelerate innovation, the subsidiary will partner with various insurtechs that bring specialized capabilities, from digital underwriting and claims automation to fraud detection and data analytics.

The long-term vision is for Iute Affinity to become a leading insurance solutions platform that supports not just Iute, but other digital ecosystems.

“Beyond traditional insurance players, we are open to working with a wide range of strategic partners where B2B2C models make sense. This includes platforms, service providers, manufacturers, producers, marketplaces and other ecosystem players looking to integrate insurance or protection into their own customer journeys,” Ribanovic explained.

Ribanovic said the product portfolio will continue to grow. The first launch will be a subscription-based travel insurance solution, complemented with additional health services. In parallel, Iute Affinity will develop a new payment protection insurance offering, available in Moldova and Bulgaria.

Iute Group is a digital banking group focused on everyday financial services in South East Europe. Founded in 2008 and headquartered in Estonia, Iute serves customers in Albania, Bulgaria, Moldova, North Macedonia and Ukraine. Through the Myiute app and its local operations, Iute offers digital financial services including payments, banking, financing and insurance intermediation. The Iute Group finances its operations through equity, deposits and covered bonds listed on the Regulated Market of the Frankfurt Stock Exchange and the Nasdaq Baltic Main List.