At the end of June, the inflow of external credit funds exceeded the outflow on their servicing, as a result of which the balance of external state debt, according to the Ministry of Finance, became positive. In the first 6 months of 2025, the net external financing of the state reached a positive value, amounting to about $118.43 million. At the same time, the fluctuation of the exchange rate of the U.S. dollar against other currencies during this period amounted to $362.77 million, which significantly affected the amount of debt obligations.

In June 2025 alone, the government received the maximum amount of loans this year – $340 million, which is 3.6 times the amount of lending for all 5 previous months. External receipts on an accrual basis since the beginning of the year amounted to $435.45 million. Thus, the balance of external public debt as of June 30, 2025 increased, compared to the balance at the beginning of the year, by $481.20 million, or about 11.5%. Thus, at the end of the half-year the amount of external borrowings of the state reached $4,671.49 million ($4,190.29 – at the beginning of 2025).

“The state’s external debt in June 2025 grew significantly, exceeding the June 2024 figure by 32.5% (by $1.145 billion). And over the last four years it has more than doubled, or by $2.376 billion, exceeding all previous levels of accumulation of external borrowing over all years of independence,” economist Volodymyr Golovatyuk calculated. And he added that the latest European receipts (the equivalent of $340 million), according to his observations, have settled in treasury accounts without increasing the spending part of the state budget. “What would it be about?”, the expert wondered.

With the weakening in recent months of the U.S. dollar, in which the external state debt is denominated, the servicing of external debt becomes less costly. Therefore, the regulator is trying its best to maintain the stability of the national currency and prevent its excessive volatility. According to aggregators, the U.S. dollar to Moldovan leu exchange rate fell to 16.7500 on July 25, 2025. The Moldovan leu has appreciated by 0.59% over the past month, while it has appreciated by 5.60% over the past 12 months.

Recall that the external public debt, according to the National Bank’s calculations, accounts for about 41% of the total external debt. And its servicing in the first quarter of the year was ahead of schedule, which allowed to reduce short-term liabilities by 14%.

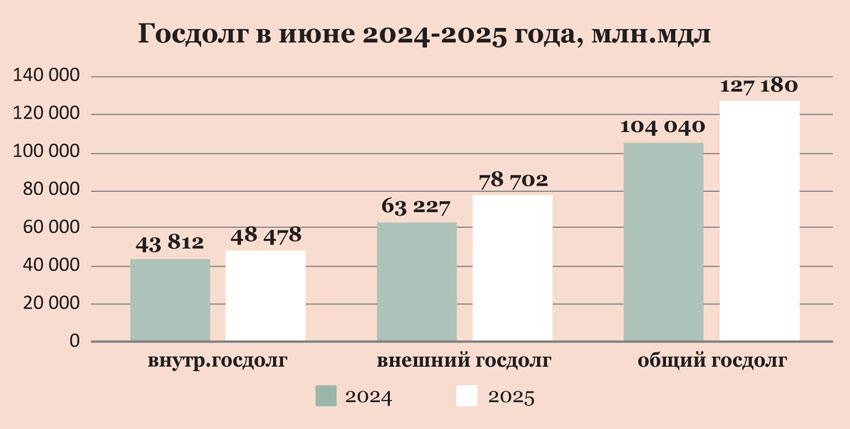

According to Vladimir Golovatyuk’s calculations, based on the data of the Ministry of Finance, the total government debt (external and domestic) at the end of June amounted to 127.2 billion MDL against 121.4 billion at the beginning of the year and 107 billion – a year earlier. Compared to June 2024, its size increased by 18.8%, or 20.1 billion MDL. The main contribution to the growth was made by the increase in external debt (+32.5%), while domestic public debt increased by only 10.7%. The increase in external public debt accounted for 77% of the total debt growth, while the increase in domestic public debt accounted for 23%.

Relative to GDP, the total public debt amounted to 36.2% in June 2025 and 33.1% a year earlier. Thus, in all positions there is a significant increase in the debt burden on the state budget, which reduces the country’s investment opportunities and puts at risk the savings of citizens, keeps the monetary and foreign exchange regulation in tension, leaving little means to stimulate economic growth, especially in the situation of currency risk and balance of payments deficit.