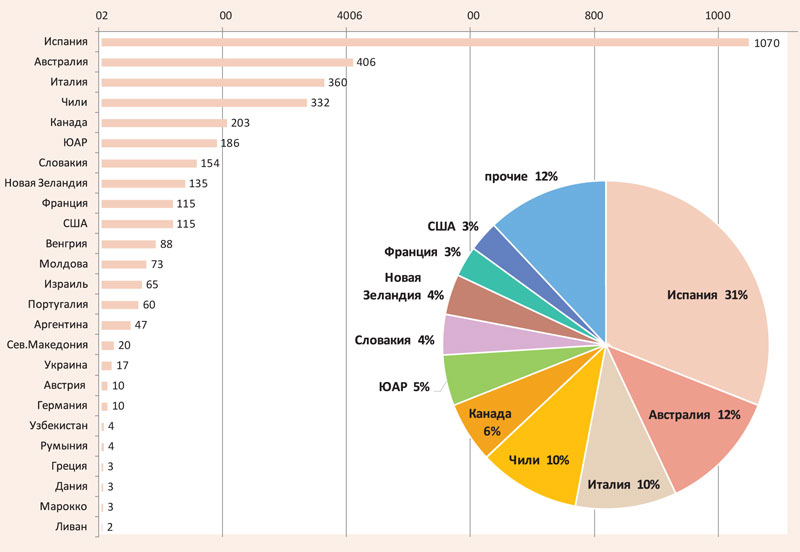

The data (see graph) coincide with the information of the National Bureau of Grape and Wine. According to them, in 2024, 73.2 million liters (still wines and liqueur wines) were shipped abroad. In this volume, the number of still wines increased by 8%, while the number of liqueur wines decreased by 16% (their share is small).

Interestingly, while domestic producers are often not satisfied with the selling prices of their bottled wines, they are not the lowest on the pour. In this volume, quite a lot of high quality wines produced according to the standards of wines with IGP (wineries themselves ask to declassify them in order to realize them as balk). Therefore, they are also priced accordingly. The average price for still wines last year was $0.66 per liter (unchanged, compared to 2023), and for liqueur wines – $1.11 (+3%).

The top 10 export countries for Moldovan wine materials included Belarus, Georgia (Abkhazia), Great Britain, Romania, Serbia, Canada, Czech Republic, Denmark, Macedonia and Montenegro.

According to Vladimir Davidescu, general director of Vinaria din Vale, the markets are currently feeling a decrease in buyers’ interest not only in bottled wines, but also in bulk. The demand for white wines is higher, so their price has slightly increased. The demand for red wines has fallen – there is a surplus of them on the world market.

Vinaria din Vale exports wine bulk to Belarus, Canada and Holland. This year white wine materials were sold on average at $0.5-0.55 per liter. By the beginning of the new grape processing season, their leftovers will also be shipped. Reds are at $0.45-0.5, and these wines will still be held in inventory. Although the margin on bottled wines is higher, but the bulk is favorable because it is paid for faster.

If the demand has shifted to white varieties, does it make sense to process part of the red grapes white next season? After all, it makes very interesting wines.

“Cabernet Sauvignon or Merlot white-style is suitable for bottled wines because the buyers of the beam want pure-variety Sauvignon blanc, Aligote, Chardonnay and especially Pinot Gris. No one is asking for just white wine, which could be sold from red varieties made with white technology. Thanks to the new harvest, which is expected to be good this year, the imbalance in the market should even out. In the previous three years, the harvest was low due to drought, which caused a decline in production, so there was a shortage of white wines”, – said the interlocutor.

For Podgoria Vin, sales of wine materials are very important, as only 20% of wines are bottled (bottling started five years ago). They export balck to Romania, Belarus, Serbia and Montenegro.

“We earn more on bottling than on bottled wines,” says Vasile Balan, the head of the company. – And it is easier to sell balk – sent two cars and that’s it. To pour the same volume of wine, you need to buy a set (bottle, cork, cap, label, box), on which you need to spend. And the settlement for bottled wines takes longer. And we ship wine materials for Serbia and Montenegro on prepayment, from Belarus the money is always received on the 90th day”.

According to the entrepreneur, recently there has been a decline in demand not only for bottled wines, but also for bulk. His buyers after the bar pour are also facing the fact that global wine sales have declined as consumer preferences have changed. The younger generation is opting more for wine beverages.

One winery owner said that red wine products were poorly marketed, while white wines were selling well (have already run out) in all segments, including high end. And colleagues in the industry who wanted white had already shipped it.

In the future, the situation on the world market will strongly depend on the USA – how the issue with duties will be solved there. So far, a temporary rate of 10% (for three months) is currently in effect for everyone, and deliveries to this country are at a reduced rate. The European market is frozen in waiting. If the U.S. duty rate increases, some of the surplus wines from Spain, Italy, France, which will not reach the U.S. market, will remain in the EU, increasing competition for the rest of the participants. This will lead to cases of dumping. Plus, most likely, there will be a good harvest in Europe this year.

The interlocutor believes that in any case, the prices for balk will go down. But it is unlikely that the wines will become very cheap, because the 2024 harvest was low. Part of the wines from the new harvest will go to build up stocks at wineries, so the market should not be excessive.

Robert Joseph, a well-known wine expert from the UK, wrote on social media the other day that he had heard from someone who was seriously looking for large volumes of wine beams at a price of 0.3 euro/liter. A Spanish export manager replied to him, “I would say that finding bulk for €0.3 is not impossible under normal circumstances, but just recently we in Spain have been hit by a hailstorm that affected the center of La Mancha and parts of the La Manchuela regions. These recent climatic events could be a game changer. It will be interesting to see if the cooperatives will keep stocks because the 2025 crop is likely to be smaller, or if they will sell.”

Joseph also said that he believes it is possible to buy wine of acceptable quality for €0.35 on the international market. But probably not in Spain (because of the hailstorm). Given that there is an offer to buy a pour for €0.3 ($0.35), and as the Spaniard confirms, it is possible, then Moldovan wineries have been selling well.