But it’s not enough for good guys to be good. They also have to be strong and determined. And I’m afraid that’s where Europe is failing. Right now, Europe doesn’t look strong at all. It looks weak.

First there was the so-called trade deal with the United States. As my colleague at the London School of Economics, Luis Garicano, wrote, it was “not a deal, but a capitulation.” Europe made a series of concessions, including agreeing to 15 percent tariffs on its key exports, in exchange for nothing.

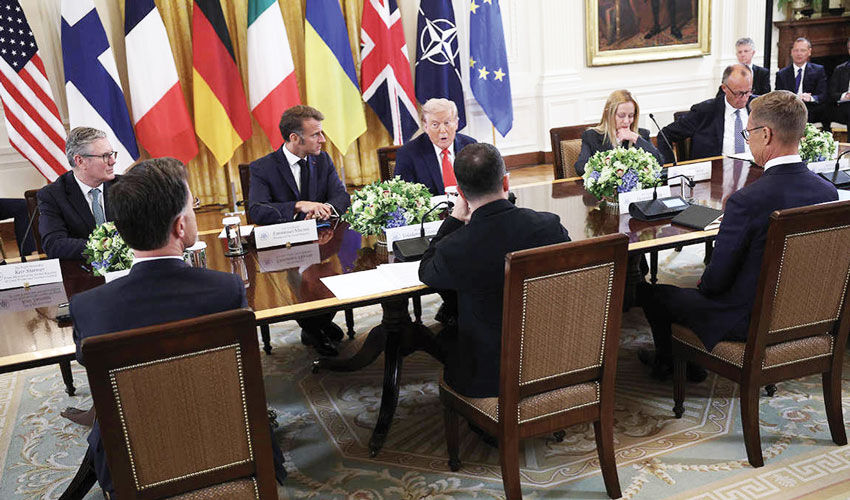

European leaders then met at the White House on Aug. 18. If there is one art that President Donald Trump has mastered to perfection, it is making a scene. He sat in his big recliner behind his big desk while the leaders of Germany, France, Italy, Finland, Ukraine and the United Kingdom, as well as the president of the European Commission and the NATO secretary general, trudged on the other side as pleasers hoping to get a job on his old reality show The Apprentice. No picture could better convey the stark asymmetry in gallo – and in real power.

But there is no reason why Europe is doomed to bow to a rogue US president. Europe has a much larger population than the US, and the combined GDP of the EU, the UK and other wealthy non-EU countries such as Norway and Switzerland approaches that figure.

The truth is that Europe’s weakness reflects its own mistakes. Let’s start with the biggest of them all: security. Garicano put it well: “You cannot win a trade war against the army that protects you.” Sixty years ago, French President Charles de Gaulle’s drive to create an independent European defense capability looked like Gallic stubbornness. Today it looks visionary. Russia’s aggression has shown that Europe is naked without U.S. security guarantees, which cannot be counted on as long as Trump is president.

Europe is not doing enough to address the security deficit. Of course, defense spending is rising. In 2024, 20 of NATO’s 28 European members will spend more than 2 percent of GDP on defense – an increase of 0.6 percentage points in just two years. But that’s still a far cry from the 3.4 percent the U.S. spends and the 4.7 percent projected by Poland for 2025.

Defense procurement in Europe is also maddeningly fragmented, with each country trying to create jobs by buying weapons locally. The result is inefficiency and delays. The proposed European Defense Mechanism, which would include the UK and serve as a joint procurement agency, is a much better way forward, as is the idea (at least in the short term) of buying from the U.S. the weapons Ukraine and Eastern Europe need for security.

All of this leads to the question of how Europe will be able to pay for its rearmament. The EU has not finalized either a capital markets union (to allow companies to borrow more cheaply across the continent) or a banking union (to break the “loop of doom” between banks and their national governments). Nor did it create a permanent class of bonds issued jointly by the EU on behalf of all its members. During the COVID-19 pandemic, a bunch of EU debt was issued under emergency powers, but it is unclear whether it will be renewed after maturity, much less serve as the basis for something larger and longer term.

And that’s a pity, because a joint Eurobond issue would benefit Europe enormously. Financing the continent’s joint defense through joint debt issuance makes more than just economic sense. Eurobonds would also help turn the euro into a global safe-haven asset, and the time for such a change is now.

After all, thanks to Trump’s antics, the dollar is looking more and more like an emerging market currency, and investors everywhere are looking for an alternative. From an investor’s perspective, bonds backed by the EU and not subject to the political and economic ups and downs of individual countries would be safer and more liquid. Thus, they would have a lower interest rate, which would save Europe a lot of money.

But the global euro would also likely be a stronger euro, and that makes politicians from export-oriented economies like Germany and the Netherlands hesitant. But perhaps a stronger euro will be the perfect excuse to complete another giant unfinished task: the single market.

The EU is supposed to be a fully unified market for trade in all goods and services, but in reality it leaves many barriers in place. For every 100 euros of value added in EU countries, only 20 euros of goods move back and forth. For the US, the equivalent figure is 45 out of every 100 dollars. This costly fragmentation was the focus of Draghi ‘s weighty report on EU competitiveness, which was published in September 2024 and is now gathering dust on a shelf in Brussels.

With Trump threatening on one side and Putin on the other, Europeans can no longer afford passivity from their leaders. The only good guy left in the world must step up. Democrats everywhere are waiting for it.

Andres Velasco,

former Chilean finance minister, is dean of the School of Public Policy

at the London School of Economics and Political Science.

© Project Syndicate, 2025.

www.project-syndicate.org