Such data is contained in a new study by EY-Parthenon, which analyzes in detail PMI’s contribution to the EU economy from 2019 to 2023. This document reflects more than just financial results: it shows the transformation of a company seeking to change the industry itself through innovation, science and human capital.

According to the study, PMI has become one of the key companies driving employment dynamics in Western Europe. Thanks to its investments, 1 million jobs have been created in 5 years. Of these, more than 21.5 thousand people worked directly in PMI, while the rest were formed indirectly – through supply chains, partner companies, related industries, including retail. This means that every job position inside the corporation generated new jobs outside of it, strengthening the economy at different levels. Thus, PMI has an impact not only on its own employees, but also on more businesses related to manufacturing, logistics, service and trade.

During the period, almost €20 billion was invested in more than 45,000 SME suppliers, strengthening local industrial ecosystems and supply chain resilience. Over €2.3 billion was invested in research and development: this advanced innovation and scientific progress across the continent. Some €33 billion appears in exports from the EU, of which €8.4 billion in 2023 alone.

The study was conducted in the context of economic challenges in the European space. It emphasizes the need to cooperate with the business environment to strengthen competitiveness in the Western market.

In doing so, Philip Morris International encourages European institutions to develop a constructive dialog with businesses that invest in sustainability-oriented research, development and innovation.

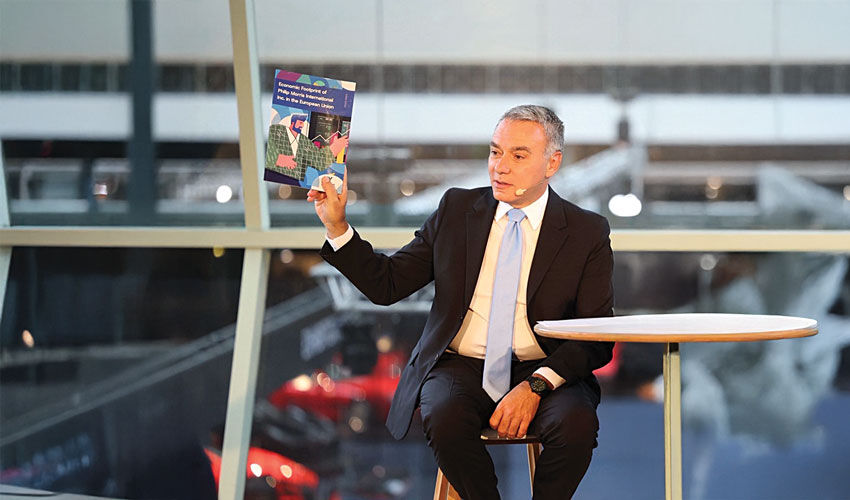

According to Massimo Andolina, President of PMI Europe Region, the company’s journey towards a smokeless future is leading to real and positive change, in which Europe is playing a leading role. “Today, more than 40% of our global net revenues come from smokeless products produced at 15 of our 19 plants in Europe. The EU must act as a priority to strengthen the future by developing a regulatory framework that will stimulate investment, accelerate innovation and harness human potential. This study reflects our firm commitment: transformation is real and a smoke-free future is being built every day, here in Europe.”

According to Massimo Andolin, the call for closer cooperation between the public and private sectors is well justified: no one should be excluded from the discussion. Fixing problems that have been accumulating for decades requires the involvement of all parties, and the private sector has a crucial role to play.

“It is internal resources that can be the key to solving the problems associated with traditional cigarette smoking. It can come from within the industry – especially from a company like ours that started investing in innovation before anyone else. We have been engaged in this process for more than 20 years. In recent years, PMI has invested more than $14 billion to support all key steps: researching the technologies, developing smokeless products, and taking them to consumers through behavior change.”

The specialist emphasized that the success of the transition to new products depends largely on how effectively tax policy is aligned. “Companies create wealth, and governments must create the conditions in which these benefits can develop. How we regulate and manage tax policy can either stimulate growth or stifle it – it all depends on exactly how it is applied. In the coming months, our challenge will be to find the balance for an effective directive. In the meantime, I am pleased that the European Commission already recognizes the specificity of smoke-free products and proposes to tax them at a separate, different rate from cigarettes. As for the taxes proposed for the different sectors, adjustments are needed so as not to limit the industry’s ability to develop.”

PMI’s European region president also noted that more than 40% of PMI’s revenues come from smokeless products: a great achievement given the size of the company. But if you analyze the data for Europe, the numbers are even higher, with about 46% of revenues coming from the smokeless category, and in some markets this segment reaches 60% to 80%.

He cited examples of countries that have managed to build an effective tax system to ensure that consumers switch from cigarettes to safer alternatives without damaging the budget. Among them are Portugal, Italy and Greece. These countries were able to realize the transition, creating positive effects for both the budget and the economy as a whole. This proves that a well-designed approach is possible and effective.

“I am convinced that in 10 years there will be a significant number of countries where we will no longer sell cigarettes,” says Massimo Andolina. – Whether we will be able to completely eliminate cigarettes from all these markets depends on the support we get from regulators and all stakeholders who can contribute to this process.”

Note that Philip Morris International (PMI) is a global company that is actively seeking to build a smokeless future and diversify its portfolio over the long term to include products outside of the tobacco and nicotine sector. The company’s current portfolio consists primarily of cigarettes and smokeless products, including tobacco heating devices, nicotine pads and e-cigarettes. As of June 30, 2025, PMI’s smokeless products were available in 97 markets. According to the company, they are used by more than 41 million adult consumers worldwide.

PMI’s strategic contribution to European competitiveness, innovation and industrial sustainability:

1. exports

- EUR 33.4 billion of EU exports over five years, including EUR 8.4 billion in 2023 alone.

- The value of PMI’s exports of heated tobacco products (HTP) competes with traditional sectors in national export portfolios:

Italy: HTP PMI exports from Italy reach €1.8 billion in 2023, almost matching the country’s olive oil exports of €2.2 billion.

Romania: HTP PMI exports from Romania exceeded €1 billion in 2022, equal to half of Romania’s wheat exports (€2 billion).

Greece: HTP PMI exports from Greece exceed €400 million, which is more than 50% of Greek feta cheese exports (€735 million).

- Average annual export growth rate (CAGR): +12%, reflecting strong international demand for smokeless products produced in the EU.

2. Impact on employment and ecosystem

- More than 1 million jobs supported

- PMI labor productivity 2.9 times the EU average

- EUR 51.45 billion in total wage contribution.

- Annual growth in supply chain investment: +9% CAGR.

- EUR 625 million for tobacco leaf procurement

- PMI’s activities contribute over €2 billion per year to farmers, impacting total agricultural wages of €10.5 billion.

- 19.6 billion euros invested in 45,000 SME suppliers

- 37 million euros in staff training.

3. investment and innovation

- Total EU investment of €43.4 billion

- Includes capital expenditure, operational expenditure and strategic initiatives

- Over €2.3 billion invested in R&D across the continent, driving innovation and scientific progress.

4. Fiscal contribution

- EUR 181.3 billion in tax revenues for EU governments.

Of this, €143.1 billion, i.e. more than 80% comes from excise taxes.