Thus, Moldova has already exceeded the world average of 140 cups per adult per year (approximately 1.3 kg of coffee beans per month). Nevertheless, the difference with the EU average remains significant: there, an adult consumes 1,170 cups per year.

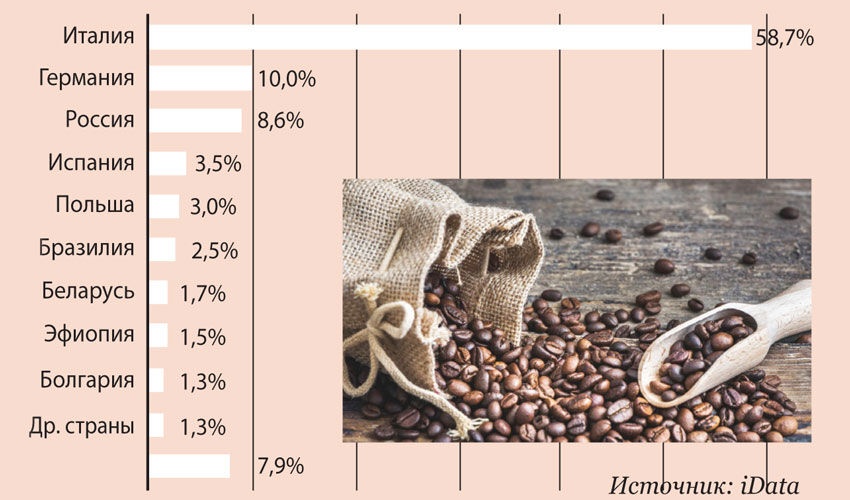

According to statistical data, almost 60% of officially imported coffee comes to Moldova from Italy. Next come Germany (10%) and Russia (8.6%). Only 4.6% of coffee is imported directly from producing countries, while the rest comes from industrialized coffee-processing countries. Thus, more than 95% of legal coffee comes from places where it is not grown, but only processed.

At the same time, not only the volume but also the price of imported coffee grows every year. Over 24 years, the volume of beans legally imported into the country has grown almost 93 times, while the price has increased from $2.92 to $8.40 per kg.

Ruslan Cojocaru, owner of the Tucano Coffee chain of coffee shops, claims that such a noticeable increase in consumption is due to a change in the mentality of our citizens: “We used to drink more tea. Now coffee drinking is becoming a daily ritual…”.

We can agree with this, taking into account the fact that 15 years ago in Chisinau and the whole Moldova there was practically no street coffee2go. And there were very few specialized coffee shops, and restaurants served almost the same assortment: espresso or Americano with one of three or four well-known brands. And street kiosks generally stirred up an instant drink.

The expansion of supermarket chains into the regions also influenced the popularity of the drink. There, the smallest store should have at least 3,000 product items on its shelves, several of which are ground and bean coffee of various brands.

Over the past years Moldova has also become a coffee exporter. As the experience of such developed countries as Italy, France or Austria shows, it is not necessary to have plantations on its territory. It is enough to import beans, blend them, roast them. And you can sell it both on the domestic market and for export, as a product that has undergone advanced processing.

Over the last three years, the main export markets were: Romania – 89.1%, UAE – 2.6%, Belarus – 1.4%, Saudi Arabia – 0.6% and Russia – 0.5%.

Export volumes, of course, are not comparable to import volumes:

|

Year |

Quantity (kg) |

|

2016 |

9 100 |

|

2018 |

17 200 |

|

2019 |

27 400 |

|

2022 |

44 500 |

| 2024 (forecast) |

40 000 |

In 2016, the export price of coffee was $13.26/kg, 52% higher than the import price of beans. The total value of exports amounted to $120,000. In 2024 and 2025, the difference between the import price ($8.24/kg) and the export price ($15.98/kg) is 48 percentage points. In 2024, the total value of exports is $639,200, which is $17.26 million less than the value of imports.

Tucano Coffee, for example, contributes to exports. However, it roasts coffee only for its establishments in Moldova and abroad (including those operating under franchises).

“Saudi Arabia and the UAE are our supplies. Also, until this year, we made blends in Moldova for Romania as well,” Ruslan Cojocaru says. – However, this year we transferred coffee production across the Prut River, because the volume of consumption there is higher, and we had to pay customs duty on green beans first in Moldova, then on the finished product – in Romania. I think that by the end of 2025, the indicators of coffee exports from Moldova will decrease”.

Cafelini company was the first in Moldova to import green beans from 8 countries of the world, to make blends and roast them many years ago. According to the co-founder of the company Marina Ceban-Gospodarenco, if you take this business seriously, you get a premium-class product. Therefore, the company has already formed a stable contingent of customers who want a quality product.

Many local restaurateurs and baristas also turn to Cafelini to have the company blend unique blends of Colombian, Peruvian, Tanzanian and other Arabica and Vietnamese or Indian Robusta for them.

“Trends show that despite the rapid growth of coffee consumption in Moldova, it remains well below the EU average. The development of local processing capacities, diversification of export markets and expansion of direct sources of supply could strengthen the sector and increase competitiveness on the international market,” iData sociologists conclude-forecast.

Features of the “shadow” market

At the same time, there is a “parallel” coffee market in Moldova, where a wide assortment of this product appears from unknown sources and is sold at much lower prices.

For example, at the beginning of August 2025, a 250-gram packet of ground Lavazza ORO costs 85 lei ($5.05) at the Central Market in Chisinau, while in supermarket chain No. 1, for example, it is sold for 211 lei ($12.55), i.e. 2.5 times more expensive. Sellers in the country’s main bazaar claim that this coffee was parceled to them by relatives from abroad.

This is somewhat doubtful, taking into account the fact that this market has more than 4000 trading places and is visited by up to 100,000 customers a day. And besides it, there are dozens of similar trading places in Chisinau and other cities of the country. Here, perhaps, we should talk about deliveries not by parcels, but in large batches.

Also, sellers do not hide the fact that there is original coffee and fake coffee on sale. They are sold at the same prices, but differ slightly in the color of the packaging.

But why is there such a price for it?

First of all, market sellers did not pay any taxes, and still do not pay any taxes, despite all the efforts of the Ministry of Economy to make patent holders individual entrepreneurs: there were no cash registers.

Secondly, smuggled coffee is purchased in EU countries during sales (when the expiration date is approaching) at the price of 1 euro per pack or even cheaper.

Smuggling also includes a scheme in which a company officially imports a large batch of goods (of any kind), but does not clear some of them. This saves at least 20% VAT. When selling for cash, no income tax is paid, which is another 12%. The Customs Service regularly detects such schemes and charges additional customs payments.

Thirdly, counterfeit (fake) coffee is brought to us from Ukraine or produced locally. Not so long ago, law enforcement authorities of Ukraine reported that they uncovered in Kiev a serious production of counterfeit coffee, which was sold not only in their own country, but also in Moldova. Moreover, local printing companies were even producing packages that could be opened by hand rather than with scissors.

By the way, a few months ago, the Customs Service of the Republic of Moldova reported that a batch of such empty packages in the amount of more than 2000 pieces was found in the possession of a Moldovan citizen while trying to import them into the territory of our country. This indicates that there is a similar production in Moldova. Probably, there is more than one.

A distinctive sign of counterfeiting can be the absence of vacuum in the package. Counterfeiters simply do not have the appropriate equipment. Therefore, such goods should be looked at with special attention.

|

Coffee imports in RM |

|||

|

Year |

Quantity (kg) | Average price $/kg |

Total |

|

2000 |

23 000 | 2,92 |

67 160 |

|

2005 |

153 000 | 3,71 |

567 630 |

|

2010 |

250 000 | 7,01 |

1 752 500 |

|

2015 |

586 000 | 6,75 |

3 955 500 |

|

2020 |

1 304 000 | 6,68 |

8 710 720 |

|

2024 (forecast) |

2 130 000 | 8,40 |

17 892 000 |