Stefan Yamandi

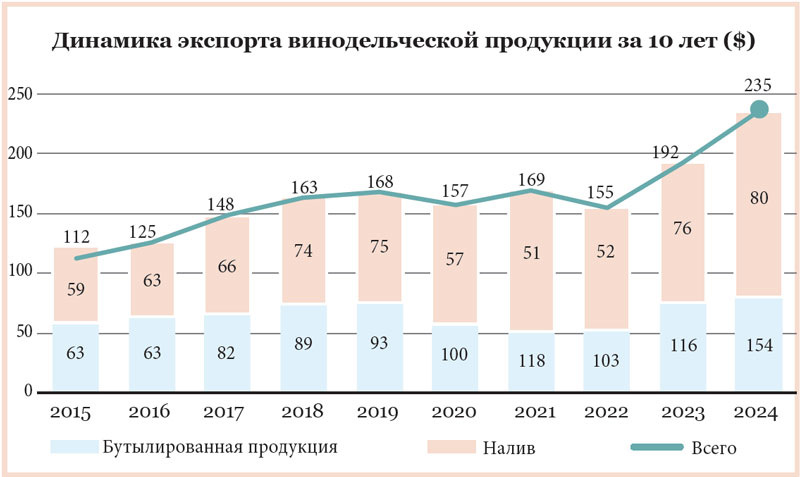

This was announced by Stefan Yamandi, director of the NBVWV, at a national conference on the results of the sector’s work last year. According to him, due to the growth of sales on foreign markets, it became possible to amend the Budget Law for 2024 and increase the fund of grapes and wine by 12 million lei. Domestic wine products were shipped to 73 countries. There are 143 exporting companies in the sector.

Quiet bottled wines were shipped to foreign markets by 3% less in physical volume than in the previous year, worth $82.6 million (+4%). Average export prices increased for all countries except Czech Republic, Russia and Great Britain. The highest prices are for shipments to Japan and Romania, as importers there choose wines of higher quality.

Bulk wine materials in physical terms were sold 8% more, for $47.8 mln (+7%). In this segment, on the contrary, prices decreased (although the average price remained at the level of the previous year). But this was in line with the changes on the market. Moldovan balk was traded at $0.56-0.83 per liter, depending on the quality, which is in line with the market trends. The maximum was paid in Romania, the minimum – in Abkhazia. Our bulk was even sent to France, where, incidentally, last year there was overproduction of wine. The secret is that French wine materials were sold at $0.85-1.01, i.e. more expensive than Moldovan ones.

Exports of sparkling wines are gradually increasing, as there is a growing demand for such products in the world. Domestic wineries supplied wines with “magic bubbles” for $8.6 mln (+12%). Their average price rose by 10%.

According to the NBViV director, there is a good potential for growth in sales of Moldovan sparkling wines. Several factors will contribute to this. Currently, the bureau is working together with producers to create an appellation of origin (DOP) for our sparkling wines. Also, the prestigious international competition Concours Mondial de Bruxelles` 2025 Sparkling Wines Session will be held in Chisinau in September. In addition, a campaign to promote Moldovan sparkling wines will be launched.

It is interesting that last year the impact on the export figures of flavored wines (vermouths) grew very much. During the year, their volume grew by 949%, to 24.6 million bottles of 0.75 liter wine. They brought in $43.7 million (+942%) – that’s 19% of total revenue. Almost the entire volume was delivered to the US.

As for bottled divinas and brandy, there was a decrease in exports both in physical terms (-30%) and in value terms (-28%). The total amount of shipments amounted to $14.9 mln. But distillates in bulk were more in demand (+10%). They were sold for $31.6 mln (+4%). Products in this segment in the total volume of wine exports occupy a small share – only 9%, but they generate 20% of revenues. And the producers of divines and distillates pay about 40% of contributions to the Grape and Wine Fund.

The EU market accounts for 51% of the total value of shipments last year, the American continent for 23%, and the CIS countries for 20%. Asia accounts for only 4% and Africa for 2% in the export structure.

“Unfortunately, exports to Asia are declining because China’s sales of grape wines in general continue to decline (all countries have been affected),” says Stefan Yamandi. – Nevertheless, the Asian market has great potential for Moldovan wines. In particular, in Turkey. Unfortunately, for political reasons, we cannot increase quotas for duty-free import of wine to this country (for several years in a row, they are already distributed at the beginning of the year – Author’s note). But there is an increase in exports to Japan, which was also influenced by the fact that the National Bureau of Grapes and Wine opened a representative office of Wine of Moldova – Japan in Tokyo a year ago, and now there is an ambassador of Moldovan wines there. Last year, a series of promotion activities were organized in this market, which gave a good effect in sales”.

The top 10 export countries for bottled wines are the USA ($46.5 million), Romania ($33.2 million), Poland ($7.9 million), Czech Republic ($7.5 million), Netherlands ($4.9 million), China ($4.1 million), Ukraine ($3.9 million), Canada ($3.1 million), Germany ($2.7 million) and Turkey ($2.4 million). It may be noted that Russia was not included in the top ten markets. With the exception of the embargo period, this is the first time. And the most stable market in recent years is Romania.