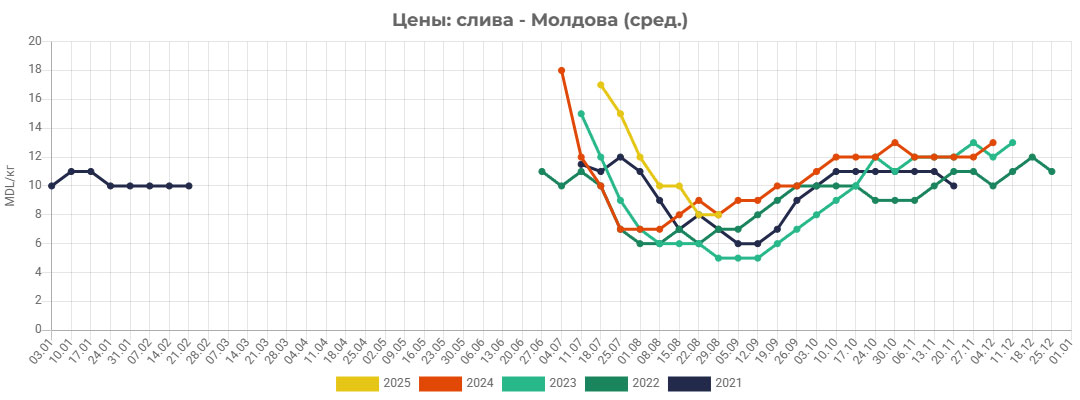

According to market operators, the period of primary high demand for plums of early (summer) varieties has “come to naught” – export sales are minimal. At the same time, the “gorge” turned out to be relatively shallow. By the beginning of September wholesale prices for plums for “fresh market” in Moldova stabilized in the range of 7-10 lei/kg. At the same time, the average domestic market price of plum “fresh” at the level of 8 lei/kg wholesale at the beginning of this fall is the highest September price in the five-year period.

However, the actual price for plums in Moldova is about 20-30% lower than in Ukraine, Poland and Russia. In general, on the Moldovan market plum is now cheaper than in all other European countries of the price monitoring of the specialized Internet portal EastFruit. Market operators explain relatively low (in the regional context) prices for Moldovan plums by the seasonal decline in external sales. In particular, there are still commodity resources of locally produced plums on the Romanian market during this period. In Germany and the Baltic States, the fruit market has Polish plums – not cheap, but it is cheaper and closer to import them from the neighboring EU country, and the quality of goods is more stable.

“The bottom of the gorge”, most likely, will not be very wide. Major operators of the fruit market of Moldova agree that the period of seasonal decline will tentatively last no more than a month. Increase in demand on the part of exporters and, accordingly, in prices for plums will appear in the beginning of the last decade of September. By this time, most likely, the stocks of own plums on the European market will begin to noticeably decrease.

Until then the relatively high (in historical terms) level of prices for plum in Moldova, as fruit market operators believe, will be kept at the expense of processing industry. Thus, producers of fruit distillates (“cuica”, “palenca”) offer 3.5-4 lei/kg for technical plum, plum paste – 4-5 lei/kg, dried fruits (“prunes”) – up to 6 lei/kg. Probably, as the harvesting of plums of fall varieties (“Stanley”, “President”, etc.) progresses, fruit freezing enterprises will join the circle of industrial producers of plums. By and large, experts consider blast freezing as a form of fruit storage rather than processing. Accordingly, requirements to the quality of “raw materials for freezing” are approximately the same as to products for “fresh market”. That is – quite high. This means that plums will be used for freezing only if a good price is offered for them – not lower than for raw materials for “prunes”.

The internal “fresh market” of Moldovan plums during the seasonal decline in export sales is quite specific. Market operators recognize that it receives products of low and, at best, average quality. At the same time, the level of “working prices” – i.e. prices of the largest number of purchase and sale transactions – is quite high for a number of reasons. Among them are price growth due to “food inflation”, and the absence of “cheap alternatives” on the fruit market of Moldova (in particular, grapes, the main autumn competitor for consumer preference, are more than twice as expensive).

By the way, in this connection, another interesting forecast of Moldovan fruit market operators. This fall, probably, between plum and grape sectors of Moldovan fruit growing there will be fierce competition “for a place in refrigerated warehouses”. Grapes have more chances – they are more expensive. But there will certainly be demand for plums in Europe, which means that there is a potential for price growth. Consequently, it makes sense for farmers to invest in quality harvesting and storage of the plum crop, which is likely to be higher than pessimistic spring forecasts.

According to expert estimates, the 2025 plum harvest in Moldova will be higher than it was thought at the end of spring. Most likely, farmers will harvest about 80-90 thousand tons of plums – as last year. At the same time, in the plum segment of the Moldovan fruit market events are developing slowly: late start of sales, not too sharp seasonal decrease in prices, not too active export. It can be assumed that if a significant volume of goods is stored, the plum sales season will be long in 2024-25.