In this context, Iurie Fale, Executive Director of Moldova Fruct, notes that last year, from the podium of Prognosfruit, the Moldovan delegate also announced a rather restrained forecast of apple harvest – about 447 thousand tons, 14% higher than the year before. However, later the National Bureau of Statistics of the Republic of Moldova issued a much more severe verdict – apple production in the country in 2024 will be only 404 thousand tons. At that time, the industry association did not publicize the adjustment of the estimate – the information is not pleasant, and a significant part of apples had already been sold by that time.

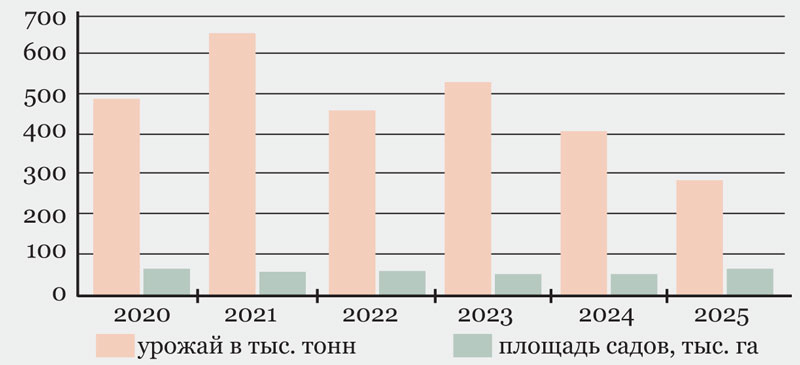

Apple production in RM was: in 2020 – 480 thousand tons, in 2021 – 648 thousand tons, in 2022 – 446 thousand tons, in 2023 – 518 thousand tons, in 2024 – 404 thousand tons, in 2025 (forecast) 277 thousand tons. The area of apple orchards is 56.6 thousand hectares, 56 thousand hectares, 53.3 thousand hectares, 51.2 thousand hectares, 46.8 thousand hectares, 44.2 thousand hectares, respectively.

The curve of apple production in Moldova in the last five years is “saw-shaped”, ups alternate with downs. Agronomists say that the factor of biological periodicity affects, which, in principle, can be smoothed by increasing the level of agro-technologies in Moldovan horticulture.

However, it seems that this is no longer enough. “World picture” is more and more formatted by global climate change. Horticulture in the most developed countries of the world is reacting to it by moving to the premium production segment of “protected ground” – in greenhouses of various types, under protective films and nets. Sometimes it saves, sometimes not. In Moldova, this is the third year of severe drought and the second year of apple crop failure.

But even against the generally unfavorable background, the forecast of production one third below last year’s level – also, by the way, more than modest – looks clearly pessimistic, “with reserve”.

In a certain sense, this is also a trend of the time. The tone in this process is set by gardeners in Poland. For the last five years, their apple crop forecasts have always been lower than the actual yields of these fruits. The motive is clear – to cause a rush demand from traders, to provoke them to a “high price start”, at least at the beginning of the marketing season. Poland is stably among the top 5 largest apple producers in Europe, therefore, the “upward game” performed by Polish farmers sometimes works. Especially in bad harvest years, such as the current one. Spring frosts have damaged fruit production in many European countries. Therefore, even apocalyptic forecasts look almost natural. However, in Poland itself, estimates of the 2025 apple harvest are gradually increasing – from 3.1-3.2 million tons in early summer to 3.8-4.0 million tons in its last month.

There are also people in the fruit business of Moldova who believe that this year’s apple harvest will definitely not be lower than 300 thousand tons. And most likely – even not much lower than last year’s. Another thing is the quality of fruits, which will definitely be low, according to the general opinion.

Moldova Fruct representatives remind that apple orchards were especially damaged by the second wave of frosts, in late April and early May. Apples of highly liquid red varieties suffered the most. The cold waves then damaged the fruits themselves, they are now uneven and in spots. It will be difficult, if not impossible, to sell such apples on the “fresh market”. It is very likely that in the future marketing season, as in the past, no less than 60-70% of the apple crop will be used for industrial processing.

Meanwhile, according to the representatives of the Fruit and Vegetable Processors Association Speranța Con, by the beginning of the new season, the situation on the European market of industrial apples and apple concentrate has undergone significant changes. In the previous two years, demand and prices for apple concentrate were high, which caused the industrial apple market to “warm up”. Its prices regularly broke historical records. As a result, farmers in Moldova (and some other Eastern European countries) preferred not to spend money on expensive harvesting, sorting and packing of apples for the “fresh market”, but to sell even good quality fruit for industrial processing as soon as possible.

This year, according to some managers of Moldovan apple concentrate factories, there is not a single factor that clearly indicates the expediency of maintaining prices for industrial apples at last year’s high level. Prices for apple concentrate due to shrinking consumer demand and the confusion with tariffs and sanctions, fell back in the spring, and continue to fall to this day. Moreover, many European producers and traders have commodity balances of last year’s concentrate.

The silhouette of an unpleasant situation is already visible. Apples will be scarce, its quality in general will be average and low. At the same time, at least at the beginning of the season, prices for apples for the “fresh market” will be high, possibly higher than usual for the fall period. Naturally, this will not please the household consumer, who is used to the stereotype: “apple is the cheapest fruit”. In order to get rid of, often, justified claims of the “fresh market”, growers will again try to massively surrender low-quality apples for industrial processing. But the producers of concentrate will not be located to give for it a price that farmers will consider “fair”. It seems that difficult negotiations await growers, traders and processors. And, in general, a difficult marketing season.