Plum is the cheapest stone fruit on the fruit market in most European countries (as well as apple is the cheapest seed fruit). From this point of view, plum is an important marker of the balance (or imbalance) of the fruit market in the aspects of supply/demand and price/paying capacity. For the fruit agribusiness of RM, plum is a basic commercial product, in the last few years occupying the second or third position in the top 5 export fruits. At the same place plum is on the list of fruit raw materials for canning, drying, freezing. Therefore, the potential of plum production and trade for Moldovan fruit growing is one of the most important indicators of well-being. But in the current unstable times “health requires money”.

Production

According to the agro-marketing specialist Andrei Zbanka, this year, under the influence of unfavorable weather and phytosanitary factors, the plum harvest-2025 in RM will be reduced compared to last year’s level by about 30% – up to 70 thousand tons.

The quality of production is also likely to be heterogeneous. The problem of underweight and caliber of fruits, at least of early varieties, does not cause concerns of farmers. In principle, a good and commercially significant plum harvest of early varieties is not a typical situation for Moldova. However, according to the observations of agronomists, the potential commercial value of commercial plums for the “fresh market” can be reduced by pests – especially mites.

Plum of late varieties, which is also unusual, according to farmers’ observations is damaged by frosts to a greater extent. However, this does not apply to the plum of the main late variety “Stanley”, which is the basis of the export potential of the industry.

There are also indications that the plum harvest, as well as many other fruits this year, will be very different in different regions of the country. Moreover, there may be a large shortage of plums in the western regions of the Republic of Moldova, especially in Nisporeni – that is, in the traditional epicenter of production of these fruits.

According to Moldova Fructestimates , over the last five years the area of plum orchards in the country has decreased from 22,8 thousand ha to 20,7 thousand ha. Most of the plantations of these fruits are so-called classical, semi-intensive, without irrigation and anti-hail protection systems. Among other reasons, plum yields demonstrate dependence on the factor of “biological periodicity”.

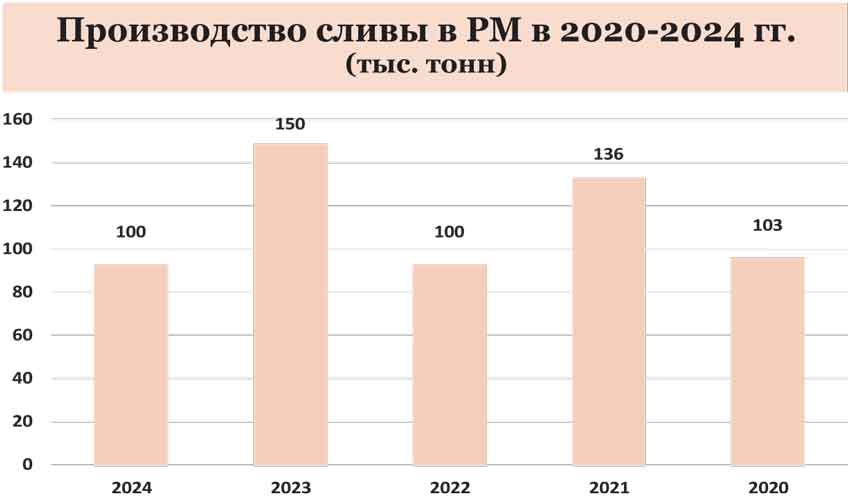

In 2024, 100 thousand tons of plums will be produced in RM, in 2023 – 150 thousand tons, in 2022 – 100 thousand tons, 2021 – 136 thousand tons, 2020 – 103 thousand tons

Export and prices

This year, the period of mass ripening of early plums, as well as many other fruits, has moved a week ahead. At the same time, active export of Moldovan plums in previous years usually started in the last days of July – first days of August. However, this year, due to the loss of a significant share of berry and fruit harvests in many European countries, high demand for these products appears in advance – before the usual dates of the beginning of sales. Taking this into account, deliveries of Moldovan plums to the EU countries will probably start already in the third week of July. Moreover, at a good price.

Judging by the retrospective price monitoring of EastFruit, at the beginning of the plum selling season the wholesale purchase price for fruits for the “fresh” market above 8 lei/kg can be considered good for the farmer. This year, market operators hope that the “working” price for early plums of export quality for the “fresh” market will be 12-14 lei/kg.

However, “high purchase price” does not always automatically mean “high export volumes”. Due to the potentially high shortage of plums in such important (for the European plum market) countries as Serbia, Ukraine and Poland, European buyers are unlikely to be inclined to compromise on the safety and quality of plums when purchasing them in other countries. And in the Republic of Moldova, relatively few agricultural producers have valid certificates of GLOBALG.A.P. and stricter standards. In addition, the post-harvest infrastructure (sorting, packing, etc.) in the plum segment of fruit growing in Moldova is noticeably weaker than in the apple business.

Of course, sometimes the “stars align”. Two seasons ago the export of plums from Moldova came close to the mark of 80 thousand tons – an absolute record. Export in financial terms – $44.4 mln. At the same time, according to EastFruit experts, in the season 2023-24 Moldova not only updated its previous (2017) record of fresh plum export, but became the world’s largest exporter of this commodity among the countries of the Northern Hemisphere. Only two countries of the Southern Hemisphere, Chile and South Africa, were ahead of Moldova in terms of external supplies of plums in general. That is, the third place in the list of world exporters of plums, you must agree, is an achievement.

But in the season 2025-26 plum exports, despite a lot of positive preconditions, are likely to be modest. It is not excluded – will be close to the anti-record of five years.

According to the Association Moldova Fruct, in 2024 the country will export 60.2 thousand tons of commercial plums (average invoice price – $0.8/kg), in 2023 – 78.7 thousand tons (0.83/kg), 2022 – 37.1 thousand tons (0.56/kg), 2021 – 52.6 thousand tons (0.5/kg).

Domestic market and processing

There is a fairly clear relationship in the fruit market: high harvest – growing consumption of domestic “fresh market” and procurement of raw materials for the needs of the domestic industry. And vice versa. Moreover, price is not always the driver in this case. Because even in conditions of deficit buyers are not always ready to pay a high price for goods of low quality. Especially for plum – traditionally one of the most inexpensive products of the fruit market in Europe.

Once again, in Moldova the size of the harvest and quality of plums this year will be average or, maybe, even lower. These two criteria will severely limit exports. The capacity of the domestic “fresh” market will be reduced by low purchasing power and psychological discomfort of the average consumer (“a simple plum cannot cost so much”).

Hence the conclusion: it is not excluded that this year in the plum segment of the fruit market of RM a “window of opportunity” will paradoxically open for processors – producers of plum paste, dried fruits and frozen fruits. If, of course, they will be ready to negotiate the purchase price with farmers. In any case, it cannot be low.